Understanding Crop Insurance

Crop insurance is a financial risk management tool that helps protect farmers from crop losses due to natural disasters, weather extremes, or yield reduction. Broadly, crop insurance can be categorized into:

- Parametric (index-based) insurance, where payouts are triggered by predefined weather or vegetation indices (e.g., NDVI, rainfall, temperature)

- Traditional (indemnity-based) insurance, where compensation is based on actual yield loss, often validated through field inspections or farm-reported data

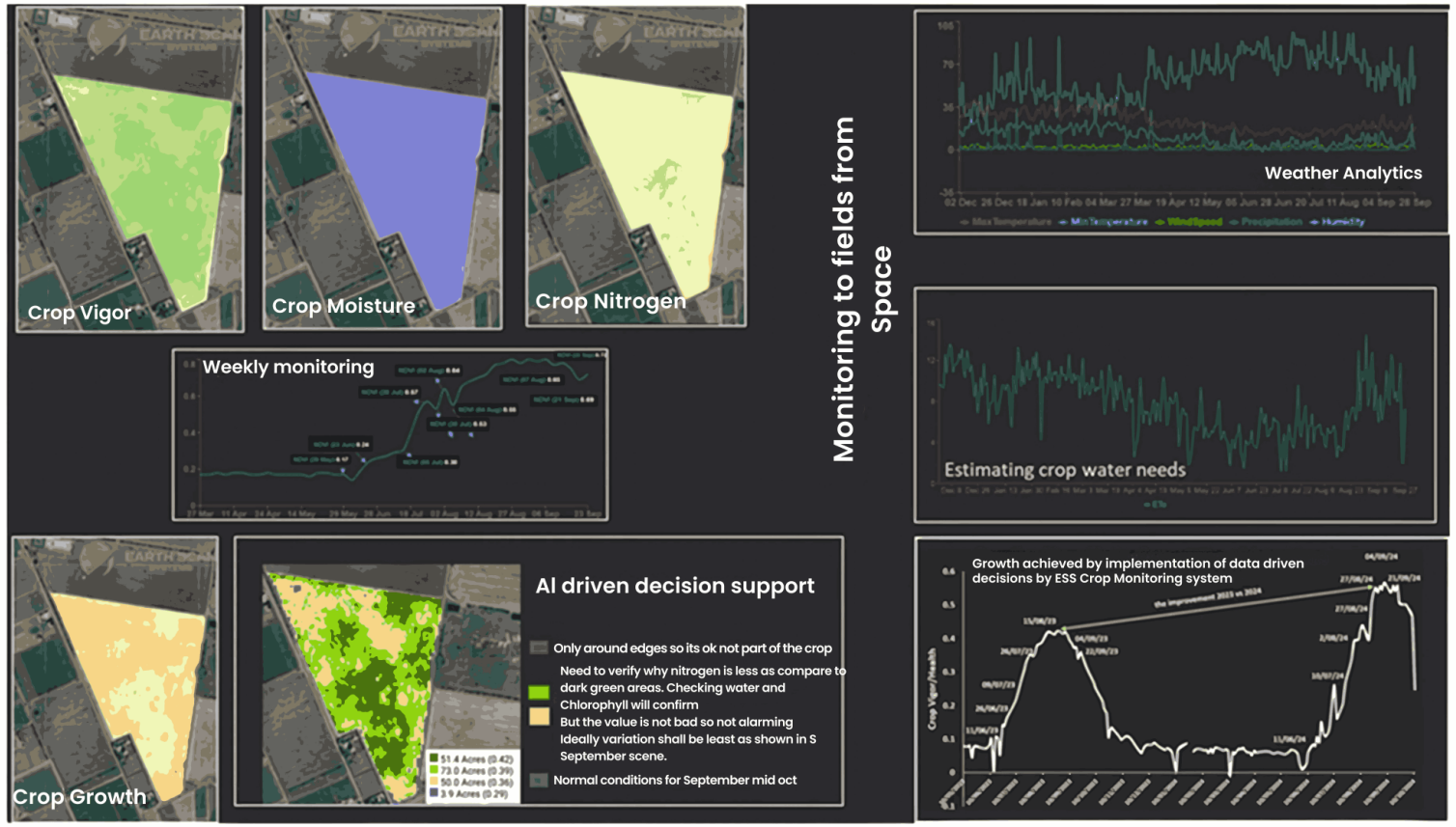

Regardless of type, both models require the same foundation: timely, accurate, and location-specific field intelligence. This includes satellite-based monitoring, weather analytics, and crop phenology tracking to ensure fair pricing, transparent claim assessment, and early detection of risk. ESS Crop Monitoring is purpose-built to meet all of these needs.

What’s Needed to Make Crop Insurance Work

For crop insurance to be practical, scalable, and fair, several critical components must be in place:

- Accurate crop monitoring across all growth stages, not just snapshots during peak seasons

- Reliable indicators of crop stress and productivity loss, such as vegetation, moisture, and nutrient status

- Historical context to understand seasonal variability and calibrate thresholds

- Timely data that supports proactive claim assessment and decision-making

- Transparent and objective tools that minimize disputes between stakeholders

Without these elements, insurers struggle to set fair premiums, detect actual losses, or ensure farmer trust. That’s where ESS Crop Monitoring steps in.

In a world where farming success often hinges on weather volatility, rising input costs, and climate risk, crop insurance is more than just a financial product—it’s a lifeline. Yet, traditional insurance models across many countries face challenges: slow claim processes, lack of transparency, and limited data to justify premium levels or payouts.

At ESS (Earth Scan Systems), we’ve developed a comprehensive digital agriculture platform—ESS Crop Monitoring—that is actively being used around the world to support precision agriculture and crop insurance workflows. The system integrates high-resolution satellite data, phenology-aware crop analytics, and agro-climatic intelligence into a unified platform.

ESS Crop Monitoring stands out for its robust combination of capabilities:

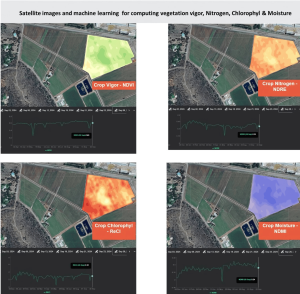

- Multi-index crop monitoring using NDVI, NDMI, NDRE, ReCI, MSAVI, and SAVI to track vegetation vigor, moisture stress, nutrient status, and canopy development through the entire crop growth cycle.

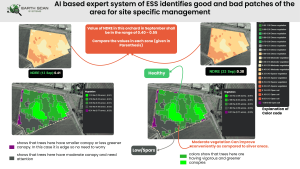

- AI-powered zoning to automatically detect and classify good and poor-performing areas within fields, enabling yield risk stratification, claim zone validation, and precise insurance modeling.

- Advanced weather analytics including 14-day forecasts and historical data for rainfall, temperature, wind, and evapotranspiration (ETo), used to calculate water stress and support FAO-based irrigation and drought assessment methods.

These capabilities make ESS Crop Monitoring not just suitable—but optimized—for supporting both parametric and traditional insurance models in diverse farming systems and geographic regions. Our index monitoring goes beyond NDVI by incorporating a suite of vegetation and condition indicators—such as NDMI for moisture, NDRE and ReCI for nutrient and chlorophyll status, MSAVI for early growth analysis, and SAVI for low vegetation cover—allowing insurers to track crop performance throughout the full phenological cycle.

Our AI-powered zoning engine classifies satellite imagery into meaningful agronomic zones that reflect actual crop performance, identifying strong and weak patches in real-time. These patterns can support yield potential assessments, damage detection, and zone-specific risk calculations.

The weather module adds another powerful layer: real-time and forecasted agro-climate data (e.g., rainfall, ETo, temperature, humidity, wind speed) is transformed into actionable intelligence using FAO-based methods. Users and insurers can visualize drought stress, moisture surpluses, and critical irrigation needs—essential for designing or triggering parametric insurance payouts.

Precision Risk Management with ESs Crop Monitoring

Our ESS Crop Monitoring platform is designed for real-time, farm-level intelligence. Users can store farm boundaries once, and the system automatically provides updated satellite-derived indices like NDVI, NDRE, SAVI, MSAVI, NDMI, and ReCI every 5 to 7 days. We don’t just show images—we use AI to classify each satellite scene into performance zones, helping users identify strong and weak patches across the field.

As insurance products evolve, the ability to combine spatially-zoned NDVI with other indices like NDMI and NDRE ensures that claim evaluations are not only fair—but scientifically grounded.

NDRE-Based Nitrogen Stress Mapping in ESS: This NDRE map highlights nitrogen variability across a citrus orchard. Dark green zones show optimal canopy nitrogen, while purple zones indicate stress or deficiency.’

ReCI-Based Growth & Chlorophyll Activity in ESS: ReCI values increase with new leaf growth and active chlorophyll. ESS maps this spatially, helping detect where crop growth may be lagging—vital for early stress detection.

Moisture Zoning with NDMI in ESS: In this example, the NDMI values across the orchard are tracked over two dates in September. AI-generated zones identify drier patches (e.g., purple areas), helping users assess moisture stress and act early. This also forms a robust basis for parametric insurance tied to drought risk.

Want to know more about these indices please read “The Ultimate Guide to Crop Monitoring in Precision Agriculture”

AI-Powered NDVI Zoning in ESS: The ESS Crop Monitoring platform uses satellite imagery and AI to classify farms into performance zones. This helps detect weaker patches (e.g., less canopy) early in the season, which can inform both input application and potential insurance risk zones which becomes an even more powerful tool when applied to crop insurance.

For example, poor germination detected via MSAVI in early stages, or low NDVI/NDMI values during critical growth windows, can signal real crop stress. In a parametric insurance model, these signals can be used as automated, objective triggers for claims.

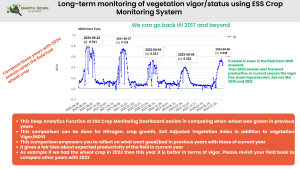

Seasonal NDVI Trend in Wheat: This example from a wheat field shows NDVI progression between March and September. The image series and time-series graph help monitor vegetation vigor over time and flag any deviations from expected growth. Such trends can feed directly into insurance models to detect stress before it becomes yield loss.

![]()

In this wheat example, NDVI values progressed from 0.17 in late May to 0.72 by mid-September, indicating healthy canopy development through the season. Temporary drops—such as those in early August—can act as early stress signals. When combined with NDMI (moisture), NDRE (nitrogen), and ReCI (chlorophyll), ESS enables multi-index parametric insurance models or enriched evidence for claim validation.

Long-Term NDVI Trends in Wheat Fields: This deep analytics feature allows comparison of NDVI performance across multiple years. In this case, the same field’s performance is tracked from 2020–2024. Such historical analysis helps insurers and farmers evaluate seasonal variability, yield potential, and risk exposure over time.

Weather-Based Risk Insights from ESS

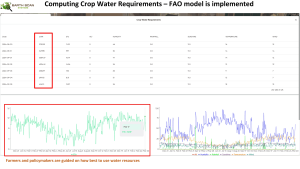

Our integrated weather module further enhances insurance potential. With 14-day forecasts and analytics for five key ago-meteorological variables, users can identify drought periods using PET vs. precipitation graphs. Crop water requirements are calculated using FAO methodology, supporting more informed decisions—and, potentially, forming the basis of index-based insurance products.

Moisture Zoning with NDMI in ESS: In this example, the NDMI values across the orchard are tracked over two dates in September. AI-generated zones identify drier patches (e.g., purple areas), helping users assess moisture stress and act early. This also forms a robust basis for parametric insurance tied to drought risk.

ESS Weather gives you Evapo-transpiration vs Rainfall: This graph illustrates how the ESS platform identifies wet and dry periods, using FAO-based PET (ETo) and rainfall data. This helps determine irrigation needs and detect drought stress. The “Critical Period” highlights high PET with low rainfall—ideal for triggering insurance payouts in parametric models.

ESS Crop Water Need Assessment plays a crucial role in crop insurance by quantifying the water requirements of crops at different growth stages using scientifically validated method – the FAO Penman-Monteith approach. By comparing these needs with actual rainfall or irrigation, insurers can objectively identify periods of water stress that may impact yield. This data-driven approach enhances transparency, supports fair claim validation, and forms the backbone of reliable parametric insurance products.

This component of ESS crop monitoring offers:

-

Objective Evidence: Water stress periods backed by PET vs. rainfall gaps are scientifically valid indicators of drought impact.

-

Field-Level Insights: Calculations are localized using farm boundaries and weather data grids.

-

Timely Alerts: If crop water needs exceed supply during critical stages, the system can flag these as parametric claim triggers.

-

Transparent Record: The full evapotranspiration and rainfall graph is archived for each field, providing a verifiable data trail for insurers.

These analytics are crucial during critical crop development stages, where prolonged dry spells can significantly reduce yield. By identifying such periods early, the ESS system not only helps in irrigation planning but also underpins weather index insurance logic with scientific evidence.

Faster Claims, Fairer Premiums

In both traditional and parametric models, the biggest value-add from ESS is transparency. With field-level NDVI histories and AI-classified stress zones, insurers can assess claims faster, without the need for full physical inspections. Our platform reduces disputes and makes it easier for insurers to tailor premiums based on historical crop health and weather exposure.

By tracking interannual variability in vegetation and environmental conditions, ESS can build a field-specific risk profile. This makes premium calculation more personalized and empowers insurers to offer dynamic pricing based on actual field behavior rather than generic regional estimates.

A Platform Built for Insurers and Farmers, Too

While farmers, agribusinesses, and insurers are all key stakeholders, ESS Crop Monitoring is designed to serve them collaboratively. For insurers and reinsurers, the platform provides field-level analytics to modernize underwriting and claim workflows. For farmers, it offers the tools to monitor crop health, detect risks early, and most importantly—assist in the claim process with credible, objective satellite evidence and zone-level diagnostics. Whether it’s for designing custom index products, validating claims remotely, or powering risk models with NDVI and weather data, we’re ready to collaborate.

Bonus: Custom Indices for Insurers

We understand that each insurance partner may have unique needs. ESS can generate custom vegetation or weather indices based on your product design—whether it’s NDVI anomalies, heat stress thresholds, or stage-specific moisture stress. With open API integration and exportable reports, your underwriting team is never left guessing.

The Road Ahead

As agriculture faces increasing climate risks and market pressures, the future of crop insurance must be smarter, faster, and fairer. At ESS, we see a world where insurance decisions are driven by real-time field intelligence, not guesswork. With ESS Crop Monitoring bridging the gap between farms and insurers, a more transparent, data-driven, and responsive insurance ecosystem is no longer a vision—it’s already taking shape.

Interested in partnering with us or learning how ESS can support your crop insurance strategy? Get in touch today or explore our platform at ESS Crop Monitoring